Sun on the Sand: Middle East and North Africa (MENA) Turns to Solar Power

June 5, 2024

UK’s BBOXX Emerges as Key Player in Togo’s Solar-Fueled Electrification Drive

June 5, 2024Primary energy demand across the 10-nation ASEAN (Association of Southeast Asian Nations) region surged 70 percent from 2000 to 2016 alongside annual economic growth rates that have recently averaged 5.1 percent. That has spurred ASEAN governments to implement a host of policies aimed at meeting growing demand for energy, including creation of a region-wide ASEAN Power Grid (APG), the ASEAN Post highlights in a recent news report.

Europe-based International Energy Agency (IEA) estimates some $1.2 trillion in capital will be needed to upgrade, modernize and expand power utility grids across the ASEAN region between today and 2040. Foreign investors from China, the European Union, Japan and the U.S., along with multilateral development banks and agencies, such as the Asian Development Bank (ADB), are making investments.

China’s ASEAN grid investments dwarf those of others. China has invested USD66 billion in power generation in Southeast Asia since 2003, 48 percent of global foreign direct investment during the period, according to the Post’s report.

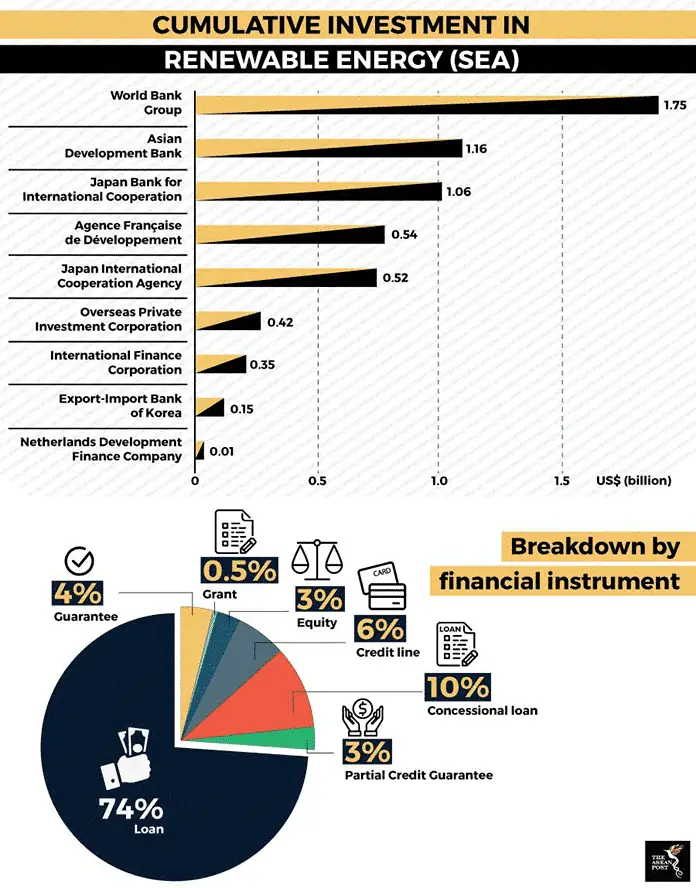

Japan has invested more than USD1.5 billion in hydroelectric, solar and wind power projects in the ASEAN region since 2009, while the Export-Import Bank of Korea has invested USD150 million in renewable energy in Southeast Asia from 2009-2016, the Post says.

Unfortunately, most of the investments from China, Japan and South Korea have gone into fossil fuel generation, which adds greenhouse gases to the atmosphere and contributes to global warming. Furthermore, these investments work contrary to achieving the U.N. climate change and Sustainable Development Goals these nations have pledged to realize.

Looking outside Asia, the U.S. Overseas Private Investment Corp. has invested more than USD400 million in ASEAN’s power sector from 2009-2016. The USAID, the U.S. Agency for International Development, aims to invest USD750 million to strengthen renewable energy capacity across ASEAN member states, according to the Post’s report.

Germany has been the primary European investor in ASEAN’s power sector.

Multilateral banks, such as ADB and the World Bank, have played a big role in terms of ASEAN power sector investment and development. The two multilateral development banks have invested more than USD2 billion and USD1 billion, respectively in Southeast Asia’s renewable energy sector since 2009.

Cover image: United Nations/flickr

Within the GCC, The United Arab Emirates and particularly Dubai leads the region in solar power. The Mohammed bin Rashid Al Maktoum Solar Park is the largest single-site solar installation in the world and covers 77 square acres – but only for now. The Park generates 700 MW of power now and the state utility, Dubai Electricity and Water Authority (DEWA) just signed a new expansion agreement to boost production to 950 MW. The site incorporates both flat-panel and concentrated solar power in a single facility. The new deal is the fourth expansion of the project and the new panels will be installed at the lowest cost anywhere in the world – 2.4 cents/kWh.

The Maktoum Solar Park current provides 7% of Dubai’s power requirements and will reach 25% with a total capacity of 5,000 MW by 2030, according to the national plan.

Dubai may be more serious about its commitment to a sustainable future than most people suspect. In February 2019, they hosted the World Government Forum, with thousands of delegates arriving to discuss the UN’s Sustainable Development Goals (SDGs).

The Saudis Go Solar – Sorta…

Saudi Arabia has made huge commitments to solar as the Kingdom apparently decided to exploit the wealth above their sand instead of the wealth below it. But in many ways – it isn’t happening. Sunlight is certainly a natural resource – they only get an average of 45 cloud days each year. The sunny days don’t seem to matter much, though. The price of oil has risen recently, and while that drives most nations to search for alternatives, the Saudi’s will stand pat, and lose interest in their solar projects.

The Kingdom’s commitment to oil is unshakable and they don’t worry too much about any renewable energy reducing the demand for oil:

Oil has never, or at least for the last 30 to 40 years, been a significant contributor to power generation, so renewables come in at a large scale – which will take time by the way – into utilities and stationary applications of energy, [but] does not conflict with the role of oil in the energy mix, [which is] primarily to transform into chemicals.

— Khalid Al Falih, Saudi Oil Minister

Saudi’s plans have been ambitious. A $109 billion solar program was announced in 2012 with the goal of producing a third of the country’s energy needs from renewables by 2032. In 2017, Prince Mohammed bin Salman rolled out a plan to build 210 GW in solar capacity. Then the price increased and interest dropped off. Climate Change couldn’t be bothering them too much. Saudi Arabia still gets 60% of its electricity from burning 1 million barrels of oil each day.

The Iranian End-Run

If the Saudis have hit a bump in their road, their nemesis across the Persian Gulf, Iran has no such problem. Faced with the embargo by from the United States, Iran has found allies and a way to side-step the sanctions imposed on trade – including the development of a large solar-power infrastructure. The Work has gone ahead in spite of renewed US Sanctions as Carlo Maresca teamed up with the EU’s Iranian shell company, INSTEX. Set-up as a French firm, the Italian contractor is doing business with this business entity rather than with Iran directly. Britain, France, and Germany have not violated the Iranian nuclear agreement and suggested the formation of the new company. It’s one of the EU’s main efforts to derail the sanctions and continue doing business with Iran.

In September 2017 construction began on the Blu Terra 2, 10-MW solar farm on Qeshm Island, Iran’s largest island. Six months later, the 20 hectares plant went online. In August 2018, Maresca cleared through the authorization process to start work on a 100 MW PV park between the Damghan and Semnan in northern Iran.

Iran is seen as a ripe market for European solar power and Maresca is just one of the many energy proposals totaling $3.6 billion (US) in Iranian energy development. Switzerland’s Durion Energy AG, teamed up with Germany’s Adore GmbH, to build Iran’s Mokran solar plant in Iran’s Sistan-Baluchestan Province. Solar power in the Persian Gulf is nothing – if not interesting…

The shift from fossil fuels to solar power and other renewable sources is a natural transition. The Middle East and North Africa (MENA) and the Gulf States are prime territories for solar power generation. As solar production increases and greater applications are found across the Gulf States, the costs for the technology globally can only decrease. Applied to the quest for freshwater, solar technology makes desalinization sustainable in terms of energy. In the end, most governments in the region have concluded that there is only one solution – solar power.