How California’s New Solar Mandate Will Affect Homeowners

June 7, 2024

The Donald’s Damage Done

June 10, 2024Clean Energy for America Act Would Rationalize, Strengthen U.S. Tax Policy; Too Bad It Stands Little Chance of Passing

Andrew Burger

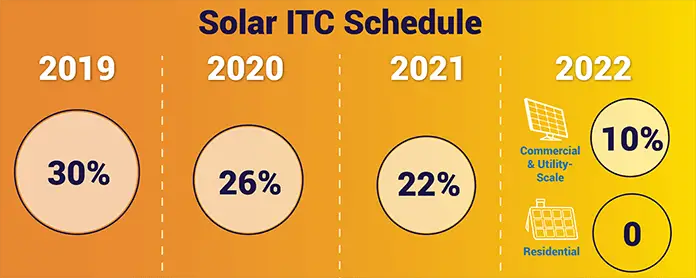

U.S. Senator Ron Wyden (D-Oregon) introduced legislation in the upper house of the U.S. Congress May 2 that would rationalize and streamline the federal tax code so as to boost clean energy and energy efficiency investment and productive capacity. Twenty-five senators—24 Democrats and one Independent—joined Wyden as co-sponsors of S.1288, the Clean Energy for America Act. The Clean Energy for America Act is a bid to “level the playing field” regarding federal tax policy and treatment of clean energy investment and production as compared to that for conventional fossil fuel and nuclear energy. “The federal tax code is woefully inadequate to address today’s energy challenges,” Wyden stated. U.S. Senator Ron Wyden (D-Oregon) Investment in and deployment of solar, wind and other zero- or low-emissions energy has been hampered by and fluctuated in parallel with the temporary and piecemeal nature of the federal investment tax credit (ITC) for solar and the production tax credit (PTC) for wind, as well as a variety of other incentives, according to supporters. At present, the solar ITC and wind PTC are being scaled down and due to be phased out, the solar ITC come 2022, except for a 10 percent tax credit for commercial solar, and the wind PTC in 2024.

A hodgepodge of temporary credits, anchored by advantages for Big Oil”

When it comes to clean energy and energy efficiency, the U.S. tax code is “a hodgepodge of temporary credits, anchored by advantages for Big Oil, that don’t effectively move us toward the goals of reducing carbon emissions or lowering electricity bills for American families. It’s time to kick America’s carbon habit, and that means a complete transformation of the tax code to reward clean electricity, transportation and conservation,” according to Wyden.

According to the Senate Finance Committee summary of the bill, the Clean Energy for America Act “creates a performance-based incentive that would be neutral and flexible between clean electricity technologies. Taxpayers are able to choose between a production tax credit (PTC) and an investment tax credit (ITC), which are scaled based on the carbon emissions of the electricity generated—measured as grams of carbon dioxide equivalents (CO2e) emitted per kilowatt hour (kWh) generated.” “The Clean Energy for America Act aims to redistribute tax credits away from fossil fuel production industries while creating additional incentive-based tax credits benefiting renewable clean energy sources. Utility companies and utility customers stand to benefit from the proposed bill since it is intended to drive energy production from clean energy sources,” Jessica Mae SumikawaSolar Magazine Interviewee Avatar, executive vice president and chief legal officer for residential solar and energy efficiency project developer Freedom Forever, told Solar Magazine. Sumikawa pointed out that the Act also encourages investment by power utilities. “Utility companies will have an interest in increasing their portfolios by investing in renewable energy resources. Some nuances exist in how a utility company benefits from the tax incentive, but there is nonetheless a vehicle for utilities to benefit,” she said. “Considering that solar is one of the main renewable energy alternatives to fossil fuels—and one which is affordable and easily able to be installed in many locations, solar is a great option for residential property owners,” Sumikawa added.

The bill includes performance-based tax credits available for energy efficient homes which will attract homeowners to residential solar. The more efficient the home is, the larger the credit a homeowner is to receive.

Clarifying and strengthening the U.S. clean energy and energy efficiency tax code

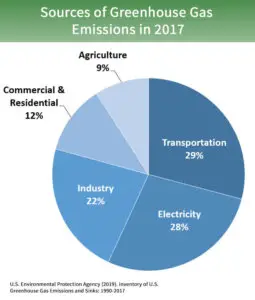

At the lowest end of the scale, power plants that emit 35 percent less carbon and greenhouse gases (GHGs) than the nationwide average would be able to qualify for a small incentive. Power plants that produce less GHG emissions would be able to qualify for tax credits at progressively higher rates. At the top end of the scale, zero-emission facilities would qualify for a 2.4 cents per kWh hour PTC or a 30 percent ITC. The PTC would be available for the 10 years after a facility is put online.

Both electrical energy and useful thermal energy would be used to calculate emissions rates, and then the percentage tax credit, for combined heat and power (CHP) systems. The useful thermal energy of CHP systems, in British Thermal Units (BTUs), would be converted to kilowatt-hours (kWh) using the facility’s heat rate, the BTUs required to generate 1 kWh. The same metric qualifies as production when it comes to qualifying for the proposed PTC. Furthermore, power plants that add energy storage technology or carbon capture equipment and come online before January 1, 2019, that would be able to claim the maximum 30 percent ITC or USD0.024 per kWh PTC rate for those investments. Energy storage technologies include hydroelectric pumped storage, thermal energy storage, fuel cells, and batteries, among others. Homeowners that install on-site generation, rooftop solar or small wind turbines, for example, would be eligible for an ITC, which would be calculated in the same way as that for business taxpayers, up to a maximum of 30% of the installation cost for zero-emission distributed generation. The Act would also reauthorize and extend IRS Code Section 48C, advanced energy manufacturing, tax credit. That would provide an additional $5 billion in available tax credits for qualified projects, such as electric vehicle (EV) manufacturing.

Pegging clean energy tax policy to emissions reductions

Clean Energy Act clean energy production tax credits would extend over a period of 10 years from the year they’re brought into service. ITC emissions reduction tax credits are to be phased out over a period of five years when nationwide emissions reduction targets are achieved . “That’s when EPA and the Department of Energy (DOE) certify that the electric power sector emits 35 percent less carbon than 2017 levels,” according to the bill. Qualified facilities will be able to claim a 75% tax credit at 75 percent value in the first year. That moves down to 50%, 25% and zero over the five-year period. Sources of Greenhouse Gas Emissions in 2017 United States Environmental Protection Agency The Act would also wipe the existing federal ITC, PTC and other clean energy and energy efficiency subsidies off the books. According to the bill, current and expiring provisions would remain in place through Dec. 30, 2018, while the phase-outs now in place would be repealed in order to provide the Treasury Dept, the Dept. of Energy (DOE) and the EPA (Environmental Protection Agency) time to transition and coordinate administrative processes and procedures.

It’s meant to streamline and rationalize the IRS (Internal Revenue Service) tax code as it applies to clean energy and energy efficiency, but the Act may make it more complicated in some ways—measuring emissions and determining rate factors for the variety of technologies involved, according to Lux Research Senior Research Associate Max Halik. The U.S. Treasury Dept. and EPA (Environmental Protection Agency) would determine “safe harbor” emission rates for similar technologies. Aiming to simplify that task, the Act allows technologies with no more than 10% differences in emissions profiles to be grouped together for purposes of calculating tax credit rates.

Clean Energy For Americas Act, Act II

It’s the second time around for the Clean Energy Act for America, an initial version of which Wyden introduced in the U.S. Senate in 2017. That bill never made it to the Senate floor for a vote. “It’s actually a pretty extensive, aggressive overhaul,” Halik said of the Act. Notably, the Act would clarify and institute some significant changes to the IRS tax code, including broadly defined tax policy and treatment as applied to microgrids and the removal of the cap on the advanced manufacturing tax credit for electric vehicles (EVs), Halik explained. Halik believes the Act will fail to be enacted this second time around, as well, however. The lack of bipartisan support (there are no Republican sponsors of the bill) and the proposed cuts to oil and gas tax incentives are two big reasons. More fundamentally, Halik doubts pegging U.S. energy tax policy to GHG emissions reductions will pass muster in Congress, particularly in the Republican-controlled Senate, and given the Trump administration’s coal and fossil fuel-driven energy policy and stance. “It’s not all about cutting tax credits to Big Oil & Gas; it’s mostly about expanding, strengthening and clarifying the tax code as it regards low-emissions energy technology. It’s technology-agnostic, as it’s meant to be—it includes a credit for carbon capture technologies, for instance, but it also cuts the credit for enhanced oil recovery (EOR), a corporate income tax extension, and another for transportation of gas and oil,” Halik elaborated.

The Clean Energy for America Act: Net impacts, prospects of passing

When all’s said and done, Halik said the Act does consolidate and clarify federal tax treatment for clean energy and energy efficiency investments and project. However, were to be signed into law, Halik doesn’t think it will reduce the soft costs of solar and renewable energy project development to any significant extent or degree given the relatively small percentage of total solar and other renewable energy project development costs they represent. The costs of bringing wind and solar power capacity online have come down so fast and installed capacity grown to the point where the enactment of the Act wouldn’t greatly impact growth in investment and deployments, according to Halik. “If you look broadly at solar and wind power, there was a slight dip in deployment rates as a result of the Trump administration’s imposition of import tariffs, but now they’re even outperforming expectations from before the tariffs were implemented,” Halik noted. More fundamentally, “prospects for solar and wind are more and more independent of policy. They’re either cost-effective, or cheaper, than fossil-fuel power generation, and there’s little that can be done about that,” Halik said. The Act would have a greater impact on emerging clean energy and energy efficiency technologies, Halik continued. In addition to energy storage, and electrification of transportation and heating and cooling, that includes offshore wind, Halik highlighted. Offshore wind power cost curves have shifted downwards significantly. Adding to that, the U.S. DOE is leasing tracts off the U.S. East Coast to offshore wind power development and some state governments have launched policy initiatives and programs that aim to achieve ambitious offshore wind power capacity development goals. The Act would clarify and strengthen tax treatment for these and other emerging clean energy technologies, adding further to growth momentum, according to Halik