PV+ Journal Mar – April 2024

June 5, 2024

AfDB approves financing for 100-MW Kairouan solar project in Tunisia

June 6, 2024The Market-Makers “De-Risking” Clean Energy Development in the Caribbean and Central America

– Andrew Burger-

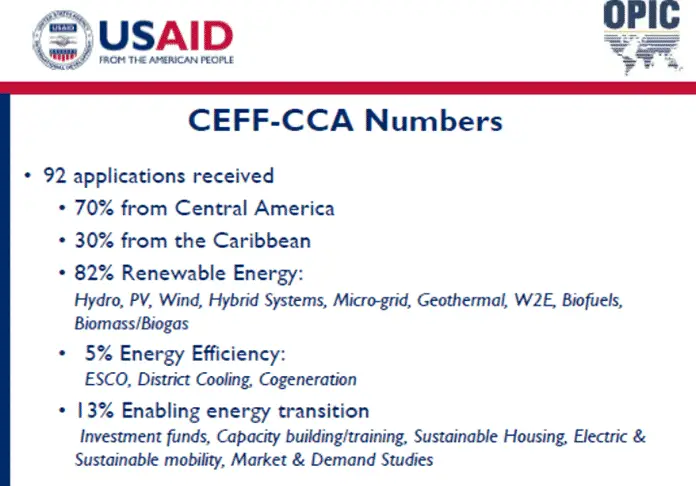

The USAID Clean Energy Finance Facility for the Caribbean and Central America (CEFF-CCA) recently held a webinar during which a group of “market-making,” clean energy pioneers explained what they’re doing to help build a structural market framework and spur development of local, environmentally friendly, renewable energy and energy efficiency projects across the region

Satellite image of Hurricane Katia (left) making landfall over the Mexican state of Veracruz, Hurricane Irma (center) approaching Cuba, and Hurricane Jose reaching peak intensity on September 8, 2017. | Source: Wikimedia Commons

June 1 marked the start of another Atlantic hurricane season in the Northern Hemisphere, raising concerns regarding the vulnerability of Caribbean and coastal Central American nations faced with another round of extreme weather events. The landfall of three major hurricanes in 2017 – Harvey, Irma and Maria – accounted for nearly all the 2017 season’s damages – a record amount of at least USD282.16 billion. Another major hurricane, Nate, was the worst natural disaster in Costa Rica’s history.

The 2017 Atlantic hurricane season also sparked a concerted effort on the part of governments and public and private sector organizations not only to restore grid power in places most affected, but to begin the work of designing and building the foundation for an electricity generation and distribution system that will prove more reliable, resilient, accessible, affordable and environmentally friendly. Solar Magazine listened in on CEFF-CCA’s webinar to gain and share insights regarding the multilateral, public-private partnership’s latest efforts to realize a region-wide, clean energy transition.

A three-year, USD10 million program to spur the clean energy transition in the Caribbean and Central America

Implemented by ECODIT, CEFF-CCA is a three-year (2015-2018), $10 million grant program supported by USAID, the US Dept. of State, the US Trade and Development Agency (USTDA) and the US Overseas Private Investment Corporation (OPIC). CEFF-CCA grant program participants are effectively serving as clean energy market-building pioneers in the Caribbean and Central America.

The first CEFF-CCA webinar, which took place in June, zoomed in on some of the program’s innovators and change-makers – organizations that have capitalized on CEFF-CCA grant funding and other resources to introduce new clean energy technology, new modes of operation, or new business models and applications that are fostering clean energy access in the Caribbean and Central America. The focus of the second webinar shifted to program partners that are in effect erecting the “scaffolding,” or “structural framework” critical to the creation of vital, robust markets, whether they be for clean energy or any type of product or service. Furthermore, via CEFF-CCA USAID is helping pioneering clean energy finance companies and institutions safely navigate and pass through the so-called new technology, start-up and market-building “Valley of Death,” CEFF-CCA Chief of Party Jorge Barrigh explained during the webinar’s introduction. Executives representing clean energy finance and investment groups, a strategic market consultant and a market, customer, engineering and technical services consultant active in Central America and the Caribbean made presentations during the July 23 webinar. So did an executive from a Honduran university program that’s emerging as a hub for renewable energy development market research and development assistance.

MGM-Innova raised some USD75 million for an initial private equity fund – MGM Sustainable Energy Fund I – and is investing that capital in the development of energy efficiency and distributed, renewable power generation projects across the Caribbean-Latin America region, from Colombia to Mexico, Senior Managing Director Patrick Doyle explained during the webinar. About 60 percent of the fund’s capital is invested in energy efficiency projects while distributed, renewable energy projects account for about 40 percent.

Orsini recently addressed this topic and its significance in terms of realizing United Nations’ Sustainable Development Goal (SDG) 7 – universal access to sustainable energy – while speaking at a conference at UN headquarters in New York City. “It was really heartening to see that many world leaders agree that this is the future of energy, and how engaged they are in the physics of the grid and how physical assets need to be managed. That includes the financial implications for some of the largest companies [power utilities] in these countries,” Orsini said. As disruptive as the rise of distributed renewable energy, energy storage and smart grid technology can be, it needn’t, and shouldn’t, destroy the power utilities we know today, Orsini added. “Some are very passionate about getting to 100% renewable energy, but that isn’t possible given existing grid models and infrastructure. It’s going to be difficult to get to 50, much less 100 percent,” according to Orsini.

MGM-Innova financed deployment of a 192-kWp hybrid solar PV-diesel generation and distribution system at Red Frog Beach.

Among other clean energy projects in its portfolio, MGM-Innova financed deployment of a 192-kWp hybrid solar PV-diesel generation and distribution system at Red Frog Beach, a residential island community in Panama’s Caribbean Bocas del Toro province, as well as financed deployment of a solar PV system and energy efficiency upgrades, including new water chillers and an air-conditioning system, for the Hotels and Language Institute in Costa Rica.

Filling in a huge financing gap

A huge financing gap exists for clean energy project development across the region, even more so when it comes to projects that combine energy efficiency and distributed, renewable power generation, Doyle explained. “Finding financing for projects smaller than USD500,000 is very difficult, and there’s a lack of capital for projects ranging from USD500,000 to USD5 million.” “It has been a real challenge to identify smaller projects and put equity capital to work,” Doyle said during his webinar presentation. “USAID has been a key partner enabling us to do that…Getting lenders, or even development banks, to finance these types of projects really hasn’t been done up until this point. We’ve been working with USAID to figure out the best way of aggregating projects that in most cases we have financed with equity capital.” MGM-Innova is nearly finished raising another USD70-75 million for a second regional clean energy investment fund. CEFF-CCA grant funding has been a key facilitator in that it lends credibility and legitimacy, as well as capital, to both the new fund and MGM-Innova as an organization. “With the CEFF-CCA funds, we’re ready to move forward and close our next fund. The focus is similar [to the group’s first fund] – energy efficiency and small, distributed renewable energy, but we’re also setting aside 15 percent of the capital for projects in Southeast Asia,” Doyle explained. Relying wholly on equity, generally speaking, leaves projected returns on investment (ROI) short of the 10 percent minimum project equity investors require, Doyle added.

A glaring lack of debt financing

All of MGM-Innova’s clean energy investments to date have taken the the form of equity capital. There’s a huge gap, and need for debt capital, as well, a point made by both Doyle and HREM CEO and President Jorge Alvarado during the webinar. Both MGM-Innova and H-REFF are working with USAID to find ways of overcoming that, Doyle noted. As helpful as it might well be in fostering banks and investors to enter or step up their clean energy financing activities across the region, a “cookie-cutter” approach to project development just doesn’t work, Barrigh highlighted during the webinar. “There’s a need for creative approaches, especially when it comes to energy efficiency and integration of renewable energy generation into the energy efficiency market space,” added Alvarado. Opportunities exist, and they’re not limited to project developments at hotels and resorts, but can be found among institutions, such as banks and hospitals, according to Alvarado. CEFF-CCA funding and partnership is enabling HREM and MGM-Innova to add their project finance pipelines by enabling the venture capital funds to identify new near-term opportunities and address the cost hurdles, Alvarado said. Being local and small, “scale becomes an obstacle when it comes to rolling out these technologies,” however, Doyle added. In part, that’s what MGM-Innova is using CEFF-CA funding to address, he noted.