Reversal of U.S. Bifacial Solar Tariff Exemption Will Bite, But Growth Expected to Continue

June 7, 2024

A Newly Released Climate Action Plan Could Unleash Ireland’s Solar Energy Generation Potential Through Making Rooftop Solar More Attractive

June 7, 2024US Import Duty Exemption Adds Fuel to Anticipated Surge in High-Efficiency Bifacial Solar PV

Andrew Burger

The US market for high-efficiency, bifacial solar panels is poised to surge higher over the course of the next 12 months, thanks to being granted an exemption from Section 201 import duties, which now stand at 30% , industry players and analysts say. The latest US tariff on global imports of solar photovoltaic (PV) cells and panels extends over a four-year period and drops 5% annually, to 15% in 2021. Able to absorb solar energy and produce electricity from both their front and back sides, bifacial solar, also known as PERC (Passive Emitter Rear Cell), panels have been shown to be as much as 27% more efficient than conventional silicon PV panels. They’re more expensive as a result, but wiping out the import duty is going to give them a big advantage in the marketplace.

That said, bifacial panels only account for around 1–2% of US solar PV installations. That’s poised to change rather quickly and dramatically due to the confluence of a number of factors, California’s solar homes mandate, as well as the Sec. 201 import tariff exemption, prominent among them, Gary LiardonSolar Magazine Interviewee Avatar, a US Solar Energy Industries Association (SEIA) director, president and COO of the consumer division at PetersenDean Roofing & Solar, told Solar Magazine.

“One of the best solutions” to an industry being plagued by import duties

The Sec. 201 import duty exemption for bifacial solar cells and modules “represents one of the best solutions yet for an industry that’s been dealing with tariffs since January 2018, and we hope it will help level the playing field for U.S. manufacturers. SEIA has been lobbying diligently for exclusions for bifacial modules, so we’re pleased with this ruling,” Liardon said in an interview.

While the number of bifacial panels being used in the United States is relatively small, we expect installations to ramp up quickly, especially with the exclusion and because it’s such an effective and efficient technology.

SEIA began carrying out political lobbying efforts advocating for solar panel import duty exemptions almost immediately after the first Sec. 201 tariffs were imposed by the US Trade Representative and President Barack Obama back in 2012–2013. That continues in the present with SEIA organizing and coordinating meetings and informational sessions between politicians and its industry members to inform them about the toll the import duties are taking on the US solar industry and jobs, Liardon explained.

Industry players were looking forward to a healthy pick-up in sales and deployment of bifacial solar panels in the wake of the tariff exemption’s announcement. That was due to several factors, California’s solar homes mandate, rising investments in solar and renewable energy on the part of U.S. corporations, and cities and states announcing more ambitious renewable energy and climate change goals among them. The Sec. 201 import duty exemption for bifacial solar cells and modules “represents one of the best solutions yet for an industry that’s been dealing with tariffs since January 2018, and we hope it will help level the playing field for U.S. manufacturers. SEIA has been lobbying diligently for exclusions for bifacial modules, so we’re pleased with this ruling,” veteran industry executive Gary Liardon said in an interview at the time.

SEIA began carrying out political lobbying efforts advocating for solar panel import duty exemptions almost immediately after the first Sec. 201 tariffs were imposed by the US Trade Representative and President Barack Obama back in 2012–2013. That continues in the present with SEIA organizing and coordinating meetings and informational sessions between politicians and its industry members to inform them about the toll the import duties are taking on the US solar industry and jobs, Liardon explained.

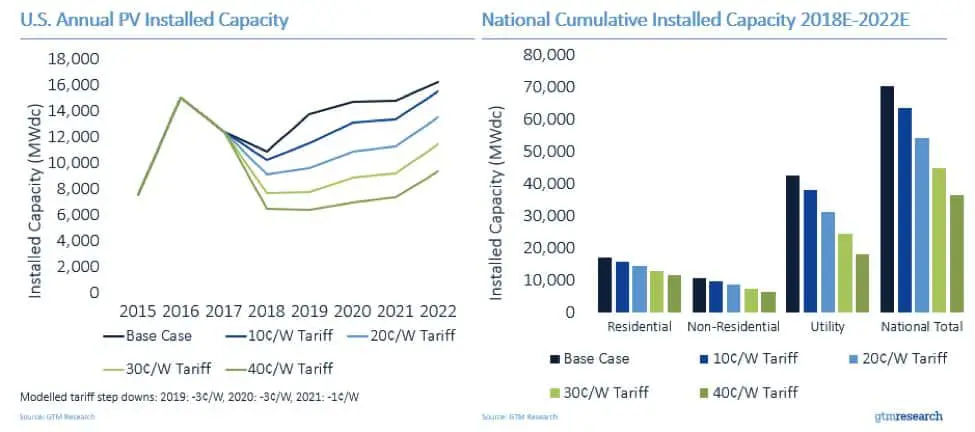

GTM Research estimates the proposed tariffs could reduce U.S. solar installations by 9 to 40 percent, depending on the level of the tariff. The Trump administration has sole discretion over the final tariff imposed. (via Scientific American) Credit: Greentech Media, GTM Research | Click here to view the full-size chart.

The US Trade Representative reviews unfair trade petitions from US businesses, reviews and investigates them and either recommends or doesn’t recommend the president institute punitive import duties. “At the end of the day, that power exists by executive order, but there’s a balance there, maybe not as much today as previously, but Congress does have an influence,” Liardon said. Solar energy today is as much to do with simple economics as reducing greenhouse gas emissions, countering climate change or improving human and environment health and quality, according to Liardon. “Republicans and conservatives are willing to listen, and they realize supporting solar energy is the right thing to do economically, as well as environmentally. It’s a fiscally responsible decision to make, which means it has a better chance and is more likely to have an effect at the executive level. Bipartisan support has definitely been growing. That’s a big difference as compared to five or six years ago,” Liardon said.

California solar homes mandate, production increases add momentum to market growth prospects

The Sec. 201 import tariffs have been taking a heavy toll on development of a lot of bifacial solar projects, according to Liardon. “These are high-efficiency panels essentially sandwiched back to back, with a reflective, back substrate. A 25% jump in energy conversion efficiency is substantial—what would be a module capable of producing 300 watts (W) jumps up to 350–360W of output…Because of that efficiency gain, the higher cost of bifacial modules will be offset by the tariff exemption, which will make them cost-effective and competitive even against conventional solar panels,” Liardon said.

In addition to the Sec. 201 import duty exemption, leading solar PV manufacturers have been ramping up bifacial PV cell and panel production capacity in bids to differentiate themselves in the marketplace and produce PV panels better suited to locations where land or rooftop availability is limited and prices high, Liardon pointed out. Price drops are expected as a result, adding to bifacial panels’ market competitiveness and growth in market demand. Furthermore, Liardon highlighted that California’s solar energy mandate for new residential construction (solar homes mandate) is set to go into effect January 1. The solar homes mandate requires all new homes built in California to be outfitted with solar energy systems. That’s going to give the Golden State’s solar energy market a big boost and open up a very large, new, retail market for now more competitive bifacial solar panels and systems, Liardon pointed out.

Import tariff exemption, California solar homes mandate make for a huge market opportunity

Up until now, a large majority of bifacial PV panel sales and system installations have been limited to utility-scale and large commercial-industrial (C&I) solar projects, Liardon explained .

In addition to the availability of land and rooftop space, from a manufacturing standpoint, the bulk of bifacial solar installations historically have been earmarked for large-scale projects. There hasn’t been a big push into the retail market. —Liardon said.

That’s poised to change dramatically as a result of the confluence of California’s solar homes mandate going into effect, manufacturing capacity growth and bifacial panel imports being exempt from Sec. 201 import tariffs, he continued. Increasing land costs in areas such as Northern California are leading home builders and architects to design and build higher density housing, Liardon pointed out. Furthermore, “residential rooftops are being designed to capture the output of higher efficiency bifacial panels,” he said. PetersenDean specializes in new residential and commercial construction. Jim Petersen founded the Fremont, California-based company in 1984. To date, PetersenDean has installed more than a million roofs, employs 3,000 workers and operates in eight states: Arizona, California, Colorado, Florida, Hawaii, Nevada, Oklahoma and Texas, according to the company.

PetersenDean Roofing & Solar is primarily a roofing company, the largest privately-held one in the US, according to management, but it’s also one of the top two or three rooftop solar installers in the country, Liardon pointed out. “California’s mandate will have a significant impact on our operations and overall annual business. We’re currently installing just under 50% of new roofs in California. Of all of those houses, we install solar on around 10 percent. That will be 100% come January 2020,” Liardon said.

The emergence of an entirely new solar market realm

Furthermore, bifacial modules will be “a much more viable play” for single-family homes, as well as multi-family housing and C&I projects, according to Liardon. “There’s an entirely different need emerging in California, particularly within the residential realm.” “These [bifacial] panels are particularly advantageous for small rooftops and high-density areas and that’s going to change the game and open up markets from a solar energy productivity standpoint,” he said. Liardon said bifacial PV panels’ market share in California could surge from 1–2% to the double digits, as high as 15–20%, over the next 12 months. “It doesn’t take long for demand [for particular technologies] to shift and market shares to change quickly,” he said. “We think there’s going to be a significant bump higher over the next 12 months depending on the pace [manufacturing] capacity ramps up, but bifacial panel market share could approach 20% within a year. A large part of that is connected to California’s mandate and limited rooftop and land availability.” Annual new single-family home starts in California are in the 80,000–90,000 range at present. Some 12,000–15,000 are outfitted with solar energy systems, Liardon pointed out.

There are around 140,000 single-family home solar systems installed in California right now, either retrofit or new home installations. The [solar homes] mandate applies to new construction, so the number of single-family residential solar installs in California is going to jump from 140,000–150,000 up to 240,000–250,000 starting in 2020.

“Obviously, the impacts of this mandate, or tariffs of any kind, make for a difficult challenge for all—builders, owners, project developers, equipment suppliers, etc.—particularly given limited rooftop space in high-density markets. There are lots of areas where [property] lots are small and rooftop space is limited, which is going to make it difficult to install solar. That’s why this exemption for high-efficiency, bifacial solar modules is such a big win,” Liardon concluded.